Income Tax Return Filing Made Easy

We have all types of income tax solutions. File your taxes with ease.

File My Tax Return

Get Started Now

We have all types of income tax solutions. File your taxes with ease.

File My Tax Return

Get Started Now

Explore our wide range of solutions

MAKE YOUR BEST SAVINGS WITH US

Optimize tax savings with strategic planning, deductions, credits, and expert advice to reduce liabilities and improve financial outcomes efficiently. Simplify tax planning with TaxSiv.

Accurate tax calculations using up-to-date regulations, ensuring compliance and optimizing deductions for maximum savings and minimized liabilities.

For smooth tax filing, GST compliance, financial planning, and more, get professional

eCA help.

Take advantage of accurate , individualized solutions supported by years of expertise.

Provide a few basic details, such as your name, address, Permanent Account Number (PAN), and any other relevant information required for your tax return.

Book eCA ExpertEasly track your income, deductions, and credits with step-by-step guidance from the eCA, ensuring accuracy throughout the process.

Book eCA ExpertReview for errors, optimize your tax details, and electronically file for fast, accurate processing and timely submission to authorities.

Book eCA Expert

Filing taxes online brings you maximum tax savings.

Comprehensive tax solutions for salaried professionals and freelancers. Maximize refunds and minimize tax liability with personalized assistance from TaxSiv.

Streamlined tax management for large enterprises. Stay compliant, reduce risks, and optimize tax planning with TaxSive's expert solutions.

Affordable and effective tax solutions for small and medium enterprises. Focus on growing your business while we handle your tax needs at TaxSiv.

We assist individuals and businesses with accurate and timely income tax return filing, covering deductions, capital gains, and more.

Get expert drafting and review of essential legal documents like sale deeds, agreements, and more.

Quick registration services for shop licenses, PAN cards, FSSAI, and other government compliance needs.

Simplify trademark registration, renewals, and get digital signature certificates for secure online filings.

We make tax filing easy, transparent, and hassle-free. With over a decade of expertise,

we provide trusted solutions for income tax returns,

GST compliance, and more-saving you time and maximizing benefits.

Easily upload Form 16 directly into the system, streamlining your tax filing process and ensuring accurate data entry for faster, hassle-free submission.

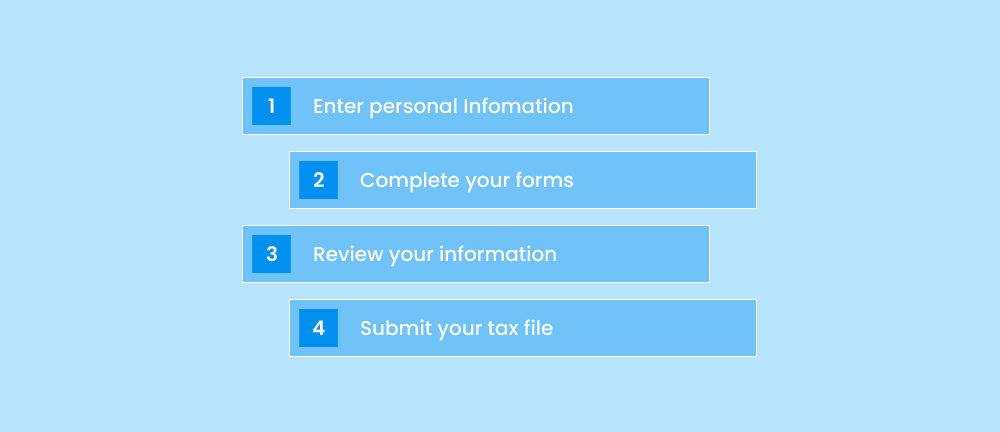

Step-by-step guide for a seamless tax filing experience, ensuring accurate data entry, maximized deductions, and efficient submission for quick processing and compliance.

Easily upload Form 16 directly into the system, streamlining your tax filing process and ensuring accurate data entry for faster, hassle-free submission.

Step-by-step guide for a seamless tax filing experience, ensuring accurate data entry, maximized deductions, and efficient submission for quick processing and compliance.

Your data is encrypted to ensure the highest level of security, protecting your personal and financial information throughout the entire tax filing process.

Copyright @ 2024 TaxSiv - All rights reserved.